- Joined

- Apr 30, 2019

- Messages

- 1,228

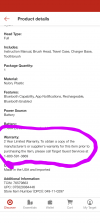

An Arkansas resident is suing Target over the marketing of "product protection plans" at our checkout lanes. These "protection plans" supposedly provide post-warranty "protection" (whatever that is). Mr. Leflar claims that Target isn't following Federal laws requiring stores to make manufacturer warranty information available to purchasers at the point of purchase, particularly before peddling an "extended warranty" "product protection plan".

I've certainly had many guests ask about manufacturer warranties on products they are buying. It isn't readily available in the store. E-commerce stores like Amazon make warranty information available online for customers to read before making a purchase. In the ancient days when Federal warranty laws were written, retail stores actually had large banks of file cabinets filled with printed product warranties available for customers to inspect. Nowadays, those warranties would be electronic downloads.

Mr. Leflar is saying that the store can't shirk the responsibility for providing warranty information to customers at the point of purchase -- which could be fulfilled nowadays in electronic format rather than having a TM go into the back office to search for the correct file folder.

While this may be yet another episode of the class-action law game -- settling with a heaping helping of attorneys' fees but with little actual change to business practices -- this lawsuit does point out the legal risks of peddling profitable "extended warranties" at store checkout lanes. Here's a store peddling an "extended warranty" to its customer, without providing info to the customer about the product manufacturer's warranty. Maybe this is why Target and Allstate (RIP Squaretrade) use the weasel-word phrase "product protection plan".

Target class action alleges retailer does not provide pre-sale access to product warranties

Target can move warranty class action back to federal court

Procedural ruling in the case

I've certainly had many guests ask about manufacturer warranties on products they are buying. It isn't readily available in the store. E-commerce stores like Amazon make warranty information available online for customers to read before making a purchase. In the ancient days when Federal warranty laws were written, retail stores actually had large banks of file cabinets filled with printed product warranties available for customers to inspect. Nowadays, those warranties would be electronic downloads.

Mr. Leflar is saying that the store can't shirk the responsibility for providing warranty information to customers at the point of purchase -- which could be fulfilled nowadays in electronic format rather than having a TM go into the back office to search for the correct file folder.

While this may be yet another episode of the class-action law game -- settling with a heaping helping of attorneys' fees but with little actual change to business practices -- this lawsuit does point out the legal risks of peddling profitable "extended warranties" at store checkout lanes. Here's a store peddling an "extended warranty" to its customer, without providing info to the customer about the product manufacturer's warranty. Maybe this is why Target and Allstate (RIP Squaretrade) use the weasel-word phrase "product protection plan".

Target class action alleges retailer does not provide pre-sale access to product warranties

Target can move warranty class action back to federal court

Procedural ruling in the case

Last edited: